Returns to Shareholders

Dividend Policy

The Company recognizes that returning profits to shareholders is one of the most important management issues, and our basic policy is to pay dividends twice a year, an interim dividend and a year-end dividend, aiming for a consolidated payout ratio of 30% and over and an increase from the previous fiscal year, while securing the necessary internal reserves for future business development and enhancing the management structure.

*Extraordinary gains from the sale of shares in LOGISTEED, Ltd. (trade name changed from Hitachi Transport System, Ltd. on April 1, 2023) is excluded from the basic policy of the dividend resources in fiscal year ended March 31, 2023.

Status of Dividends

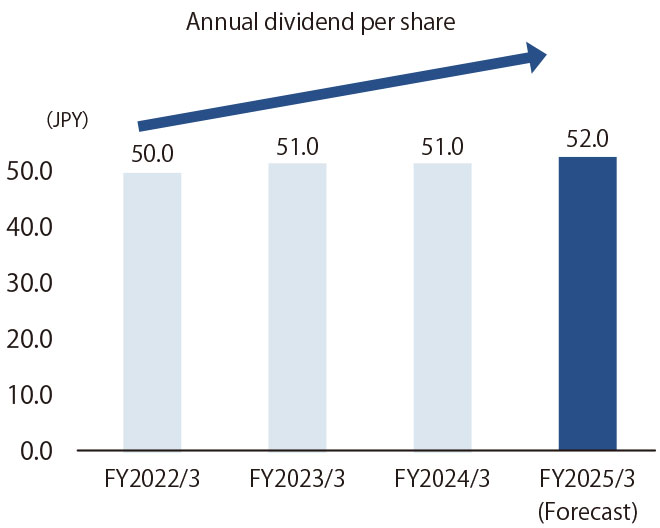

Annual dividend per share were 51 yen in the year ended March 31, 2024. The dividend forecast for the year ending March 31, 2025 is 52 yen per share.(As of April 30, 2024)

| Dividend per share | Remarks | |||

|---|---|---|---|---|

| Interim | Year-end | Annual | ||

| FY2025/3 earnings forecast |

26.00 yen | 26.00 yen | 52.00 yen | |

| FY2024/3 | 26.00 yen | 25.00 yen | 51.00 yen | |

| FY2023/3 | 25.00 yen | 26.00 yen | 51.00 yen | |

| FY2022/3 | 20.00 yen | 30.00 yen | 50.00 yen | |

Purchase of Treasury Shares

| Period of acquisition | Total number of shares acquired | Total value of the acquisition of shares |

|---|---|---|

| May. 1, 2023 - Sep. 22, 2023 | 4,769,200 shares | 9.99 billion yen |

| Oct. 3, 2022 - Mar. 24, 2023 | 5,036,600 shares | 10 billion yen |

Cancellation of Treasury Shares

The Company does not have any plans to cancel treasury shares at present.

Shareholder Special Benefit Plans

The Company does not have any plans to implement shareholder special benefit plans at present.